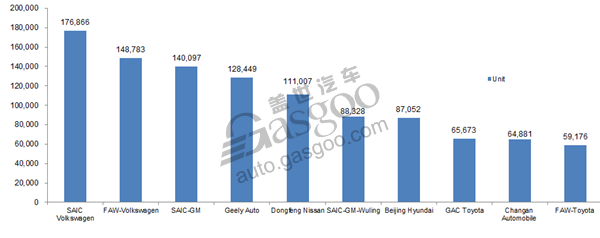

Top 10 PV automakers by June wholesale volume, CPCA

According to the data released by the China Passenger Car Association (CPCA), China's PV retail sales reached 1,687,382 units in June, not only edging down 3.1% year on year, but also falling 6.4% month on month. For the first six months, the national PV retail sales were 10,974,412 units, climbing 4.0% over the previous year, which was 3 percentage points higher than that of the corresponding period in 2017 (the “PV” mentioned here refers to car, SUV and MPV locally produced in China).

Last month, the wholesale volume in China's PV market totaled 1,835,269 units, edging up 2.9% versus the performance in the year-ago period, while slightly declining 0.8% from a month ago. With respect to the performance of each segment, the wholesale volume of the SUV presented a much slower year-on-year growth of 0.5% with 746,069 vehicles delivered in June. The car segment maintained a comparatively robust momentum with its sales increasing 9% year on year and 1.6% month on month to 963,841 units. However, the MPV segment faced double-digit year-on-year drop in monthly sales with 125,359 vehicles delivered last month.

The top 10 automakers by wholesale volume in June as well as the ranking had some changes over the previous month. Geely Auto and Changan Automobile were the only two Chinese-owned automakers among the top 10 automakers, ranking fourth and ninth respectively. SAIC Volkswagen remained the championship, which saw its wholesale volume up to 176,866 in June. FAW-Volkswagen and SAIC-GM were the runner-up and second runner-up on the list with their rankings reversed compared with May. Great Wall Motor and SAIC Motor PV failed to enter the top 10 list last month, while GAC Toyota became a newcomer instead.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth