China's electric vehicle sales in October

After a record-breaking September (104,900 plug-in electric vehicle sales), one would think that the market would take some time to breathe in October, but that wasn’t the case, with close to 120,000 registrations last month, breaking the previous record by a significant margin (14%). Overall, October 2018 electric vehicle sales were up 85% year over year (YoY).

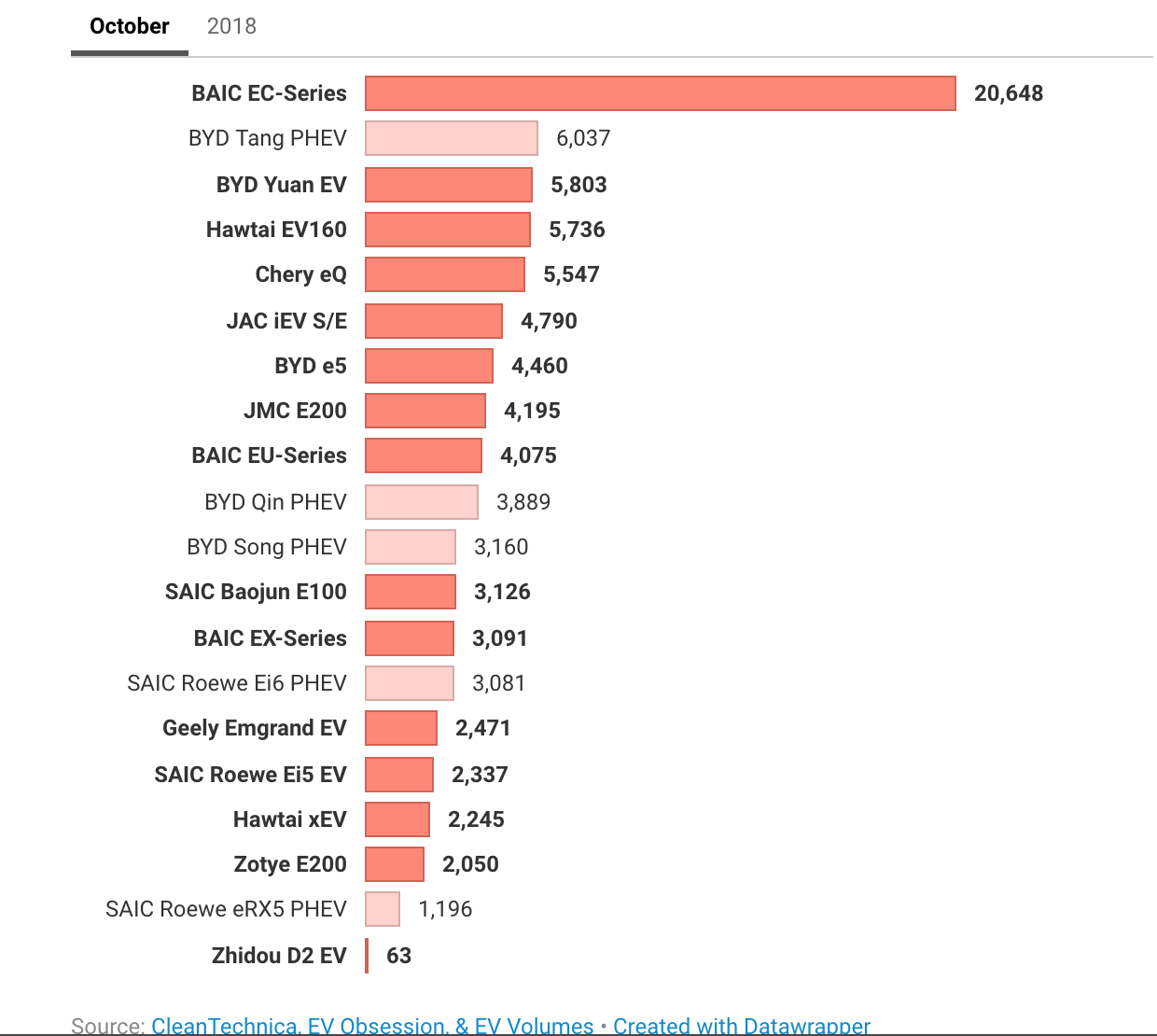

China Electric Car Sales (October 2018)

Sales figures here are not 100% official.

In October, the headlining news was the BAIC EC-Series surging to over 20,000 units, beating everyone’s expectations, while stealing the month’s top spot from BYD’s Dynamic Duo (Tang and Yuan).

Here are October’s top 5 best selling models:

#1 — BAIC EC-Series: The little EV is back with a vengeance, with the EC-Series registering a record 20,648 units last month, up 83% YoY. That led to its first best seller trophy since May. Having beaten the previous all-time best (15,719 units, last November) by a sizable margin, BAIC’s EV continues to disrupt the Chinese market, reaching a top 20 position in the mainstream ranking for the first time. The revised design and improved specs (new 30 kWh battery) allowed the EC-Series to remain a popular choice in Chinese megacities. It was also helped by a competitive price ($25,000, before subsidies).

#2 — BYD Tang PHEV: After six months on the market, the second-generation Tang seems to have found its cruise-speed sales rate — around 6,000 units/month — and ended the month with a record 6,037 registrations. Sales should continue strong for BYD’s successful flagship, and new record sales could still be achieved this year, at least until the BEV version of the Tang lands. As for the current Tang PHEV’s specs, BYD’s sports SUV saw the battery grow to 24 kWh, leading to an increased 100 km range (62 mi NEDC), or around 70 km (44 mi) real-world range. In the power department, things stayed the same, with some 500 hp and 0–100 kms/h in less than 5 secs. All for CNY 279,800 / $40,816.

#3 — BYD Yuan EV: We all knew that BYD’s new baby crossover was destined for success, and with a record 5,803 deliveries in October in its fifth month on the market, BYD’s new baby is living up to expectations. Will the Yuan be the fiercest competitor next year to the all-conquering BAIC EC-Series? I guess it will depend more on BYD’s ability/willingness to make them in volume than actual demand, since it is sitting on the vortex of the two fastest selling segments (compact crossovers and EVs). With unrivaled specs (42 kWh battery, 305 km/190 mi NEDC range, 174 hp motor) for the price ($25,000), BYD might have found in this new model its star player, crowning what it is already a strong lineup.

#4 — Hawtai EV160: The automaker’s bread and butter city EV narrowly escaped the subsidies cut early this Summer, by presenting 5 km more range (155 km NEDC) than the subsidy minimum (150 km). That was thanks to a 21 kWh battery, and sales have reflected this improvement. Sales benefitted from the reduced competition, as the little EV hit a record 5,736 units in October. With basic specs (41 hp lawnmower motor) and design, Hawtai is using a bargain-basement price (CNY 102,800 / $14,812) in order to allure carsharing and other fleet-buying companies.

#5 — Chery eQ: Chery was one of the Chinese brands to bet early on plug-ins, having won the model title three times in a row (2011, ’12, ’13) with its tiny QQ3 EV. Now, the automaker is trying to regain relevance with the eQ, the spiritual (and material) successor to the QQ3, and the model registered 5,547 units in the last month (a new year best). A vehicle marketed to city dwellers, for $24,000 before incentives, you get a funky city EV with a 22.3 kWh battery providing just enough range (200 km / 125 miles NEDC) to cover the needs of the urban jungle (and subsidy requirements).

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth